Banking on Land vs Prosperity

Aims:

1. To get across that the UK currently banks on land

2. That banking on land does not help prosperity

3. That prosperity is systemic, in that the rules have to be designed to allow for prosperity. Without the correct design, prosperity will remain elusive.

4. To show how by taxing land values we would be solving the problems caused by land speculation, which is what our current banking model is based on.

5. To Improve Land Value Tax Shift literacy in the room.

Structure:

In the next 60 mins session we have 4 elements to cover,

- I am going to present a Magic Trick Bingo Game

- We are going to watch some clips from The Taxing Question of Land to help us understand what Land Value Tax Shift is

- Explore research from New Economics Foundation about banking doom loops

- We are going to go through a workshop, which will help to think through how land value taxation works in preactice

A-Z Participatory Magic Trick Bingo

Magic Trick / Bingo Explanation

I am going to present one idea that is a remedy to all of these problems, and throughout the talk I’d like some assistance from the audience. Each time you can explain why the remedy solves a problem I want you to shout bingo and put your hand up.

(Things that Land Value Tax Shift can solve:)

a. Creating a surplus of fiscal revenue that can be spent on various things.

b. Improving the use of domestic land so that more homes are available (Addresses the housing crisis)

c. Improving the use of non domestic land so that land in valuable areas will be used effectively.

d. Provide a starting point for localism and community planning to deliver results (Coupled with democratised local planning commissions it can help communities to decide what the best permitted use is.)

e. Lowering crime in the form of vandalism and fires

f. Encouraging local investment

g. Create more money for people who earn it

h. create positive economic cycles (prosperity)

i. Provide revenue for a sizeable portion of our budget

j. Regulate housing prices so there are no more bubbles and crashes.

k. Create more choice for renters.

l. Create better services that are paid for without regressive taxation

m. Reduce inequality (improving health outcomes and lowering crime)

n. Encourage public transport

o. Pay for transport and other infrastructure

p. Make various things, including living and housing more affordable

q. Suggest what things should be nationalised and what should be private.

r. Increased investment in productivity

s. Be good for Business and good for Employees at the same time.

t. Reduce Urban Sprawl and resulting pollution and utility waste

u. Lower or eliminate tax evasion and avoidance

v. Incentivise productivity

w. Lower or eliminate taxes that suppress the economy

x. Create a non-invasive way to value property taxes

y. Change the UK banking system to bank on prosperity (compare to German model)

z. Provide a safe foundation for basic income – whether agreed with or not, without the LVT remedy, Basic Income will not work

3 Film resources for talk

All clips are from The Taxing Question of Land available from Youtube

Film 1. What is LVT?

Film 2. Infrastructure effect on Renters vs Freeholders

Film 3. Tax Compliance

New Economics Foundation Research

“Why you can’t afford a home in the uk” by @neweconomics

By Josh-Ryan Collins, Associate Director of Economy and Finance, NEF

Notes:

1. UK house prices are 9 x average incomes

2. As banks become too big to fail they become riskier knowing they will be bailed out as in 2008.

(doom loop)

3. Land provides a further doom loop.

4. If mortgage lending grows more than supply of homes, house prices rise.

As house prices rise, households have to take out bigger mortgage loans – boosting banks profits and capital…

Doom loop

Until an economic shock such as fall in salaries / interest rates rise and then everything goes into reverse.

5. In UK, we have expanding domestic mortgage lending from 40% GDP in 1990 to over 60%now

Vs ordinary non-financial businesses who want loans being between 20-30% all the way through

6. In Germany, 30% GDP is mortgage lending and 40% lending to non-financial businesses (productivity)

We need to diversify what banking is based on and shift from banking on land (mortgage lending) to banking on productive enterprise (non-financial businesses).

The rest of that article explains the difference between our types of banking culture and suggests some ideas for what we can do for better banking and land practices.

A Tale of 2 Towns (in two different universes)

Purpose of the different universes is so that they don’t interact with each other.

Part 1

1. First draw a line in the middle of the page on the left will be Town A and on the right Town B

A has Land Value Tax, B does not

2. Draw 3 points of a triangle in each town – taking up most of each side of the page like this: with the top being one dot and the two bottom dots being in the bottom row.

You are the council of both towns and in the first 5 yrs you have to decide whether to invest in a school or a hospital in the top dot.

Have a think about it and choose. Write down your answer on the top dot.

Now pair up with the person next to you. Decide which of you is ‘a’ which is ‘b’. ‘a’s talk 1st and ‘b’s listen, then switch: for 1 min explain why you made your choice and what you think it will do to the surrounding land value.

3. OK, everyone come back together. Lets discuss as a group, but before we do I want us all to draw a 2 concentric circles around the top dot.

Inside the first circle represents reasonable walking distance

And inside the second dot represents reasonable driving / public transport distance

In which of the two will Land Value be highest? (walking distance)

Why? (access to services, jobs and/or transport improves land value, walking distance = easier access)

Are there any other things that came out of discussion about land values?

4. The 2nd circle is imagined – it actually would look more like this with road lines drawn in or with a train line off the map coming into that space…

Part 2.

5. OK, it’s 5 years later, the townsfolk have decided to build a park in the bottom right spot.

But it will cost a certain amount of money.

Lets compare Town A and Town B in terms of land value.

Land value has increased, in both, but the land values from A have been collected by the council. For Town B they have gone into the pockets of homeowners inside the circles.

Whats happened to rent in both towns? (its gone up)

If banks are banking on land, who are they lending to? (Town B landowners – who now own more collateral land value)

What are the options for building the park in town A? (use collected land value)

What are the options for building the park in town B? (raise taxes for everyone – which affects renters worse than it affects landowners. They can limit the effects by working an extra job but then all that productivity is also taxed higher.)

If we wanted a system that banked on productivity instead of land which town would our bank go to? (Town A which is not adding taxes to productivity)

Part 3.

6. 5 yrs on and a private investor is thinking about building a shopping centre in the bottom left dot.

Which town would you choose and why?

(I’d choose the town which has more people with more money in their pockets – those who keep more of what they earn as more money in more people’s pockets is more likely to be spent in my shopping centre. Town A)

Part 4.

A noisy sewage treatment facility is to be built in the town – we’ll place it in between the shopping centre and the top dot. You can have a think about where you would place it – there is not necessarily a right answer here but it is interesting to consider. Draw 2 circles around it. What happens to the land values? (they go down in a similar proportion to how the other services went up – because the noise and potentially smell will lower land values surrounding it)

OK, so how does this interact with the other town services?

Why might you want to buy a house in the margins of the noisy sewage treatment facility?

Pay a bit less for a home and in annual land value tax while still having good access to services.

Which of the two towns can offer the cheapest system / mechanism for compensation for someone who already owns a house near the new facility?

(In Town B there is no mechanism in place – people would have to apply for compensation. The process is by no means straightforward and does not always result in fair compensation. In Town A the compensation will be represented in next year’s annual land value tax)

Part 5.

As more investment (eg the shopping centre and increased services) comes into Town A compared with Town B, there is more land value growth in Town A. More land value tax is collected from the growth. Town A is now collecting a surplus of taxes and is able to lower other taxes. For the purpose of the exercise, have a think about which of these you feel is the least positive tax and then discuss with your a/b partner why.

Payroll, Income or VAT

What effect would lowering Payroll have on the two Towns?

(businesses have more money to train their staff, or hire more staff or pay more to staff or to invest in the business)

Income tax?

(Earners would keep more of their earnings)

Vat?

(the cost would lower on sales – likely more could be bought)

In all 3 cases, productive economy would be taxed less, the money in the economy would be higher, land value would likely become both more affordable but also rise to accommodate a more vibrant economy as people can compete with more money for the land value.

This is the essence of land value tax shift.

Finally

Part 6.

There is a property crash, which town would you rather live in?

A factory is to be built – which town would you rather build it in?

Which of the two towns gets prosperity?

OK, back to Bingo, we may have a few elements left to cover.

1. Invasive nature of Council tax.

2. Urban Sprawl

3. You are a land owner – what decisions are prudent to consider if the land you own is taxed annually based on its value?

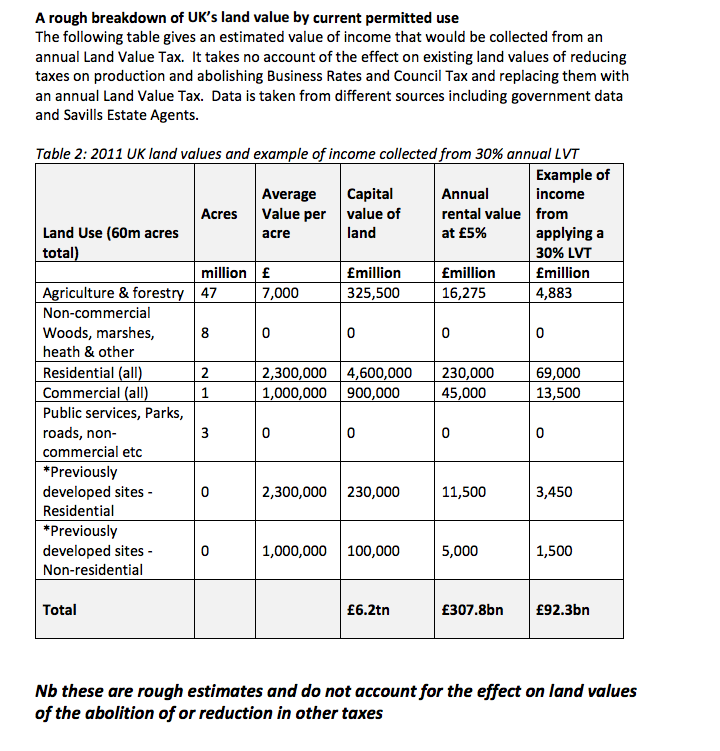

Appendix – A

Taken from Welfare for the Rich by Vice Chair of Labour Land Campaign, Heather Wetzel

Land Value Tax could raise…

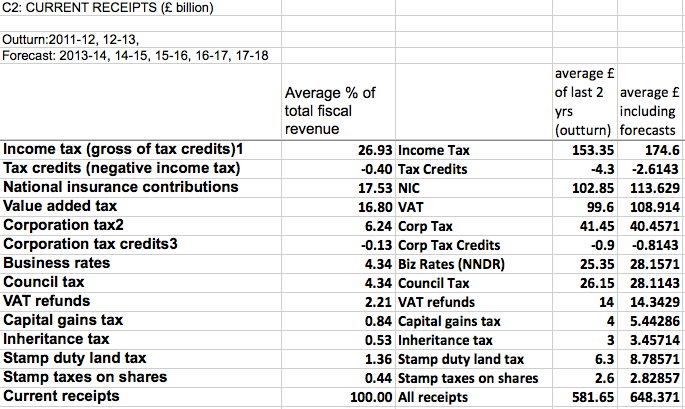

Appendix B – Averages and percentages of Fiscal revenue in UK

Information extrapolated from

DATA: download the full spreadsheet

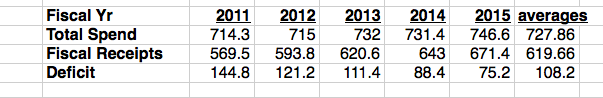

Appendix C – Budget spend vs Fiscal revenue vs Deficit, averages.

Taken from previous info + UK Public Spending Resources